Sierra Club is the most historic grassroots environmental organization in the country. For more than 130 years, we’ve gathered millions of activists and volunteers to fight for the places, people, and planet we all love.

382 Coal Plants Retired

We are addressing the climate crisis by stopping the expansion of fossil fuels and accelerating the transition to a clean energy economy.

439 Parks and Monuments Protected

We are at the forefront of the movement to preserve the beauty, natural environments, and recreational opportunities that public lands and waters provide.

64 Local Chapters

We partner with the most impacted communities to ensure all people benefit from clean air, fresh water, a stable climate and a direct connection to nature.

Join Our Movement

We can stop the climate crisis. But we must act now, together, to save our home, our world. The Sierra Club has people in 50 states across the country ready to mobilize. Will you join us?

Get involved in

We’re building a movement that helps people from all walks of life connect to protect the places they live and the lands they love. See what’s happening in your neck of the woods.

Learn MoreGet Outside

The Sierra Club Outings program provides environmentally friendly outdoor adventures—from Tahoe to Tibet—for people of all ages, abilities, and interests. Find a trip that feels like it was designed for you today.

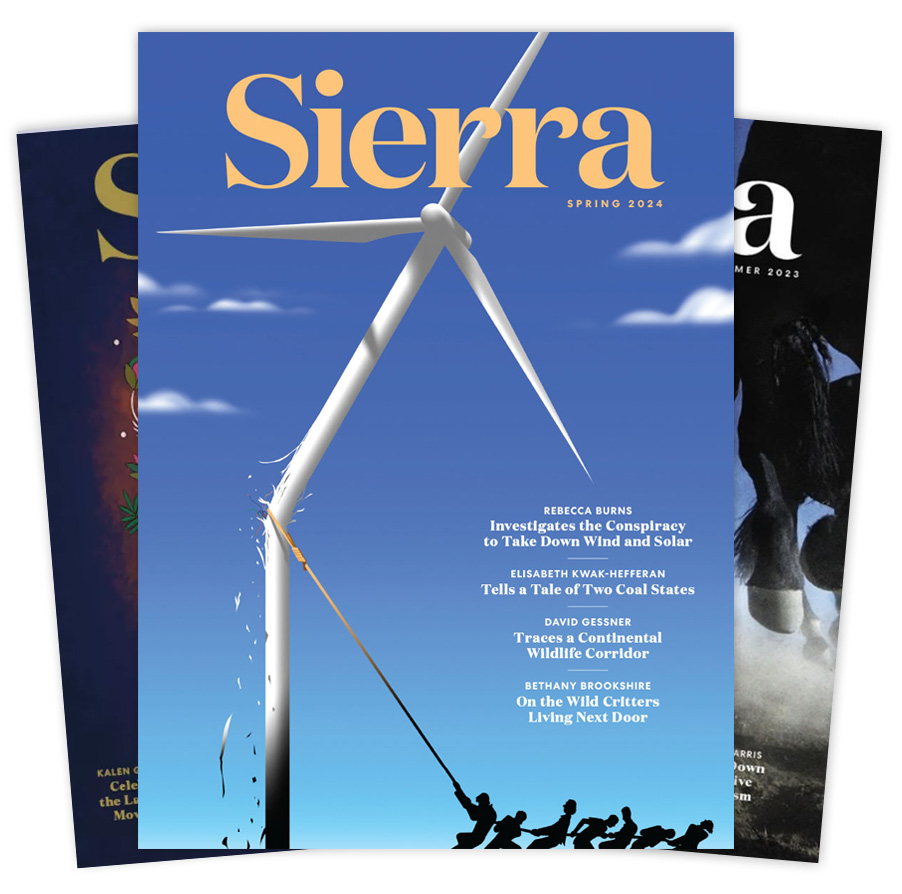

Sierra Magazine

Sierra is a national print and digital magazine publishing award-winning journalism. It combines features on green living and outdoor adventure with reporting about threats to the environment, conveying the ideals at the heart of the Sierra Club’s mission. Sierra Club members enjoy a free subscription to Sierra.